Thank you GEICO for sponsoring this post.

As a lot of you know, I’m graduating college this semester! As someone who is a huge worrier, I am already writing down all of the things I need to do when I graduate. And I’m also making dozens of spreadsheets.

I mean, this is it. I will, officially, be an adult. I can buy alcohol and I can rent an apartment but also I have to start paying even more attention to my credit score and savings. Post-grad life is going to be stressful but it’s also going to be exciting. Here’s exactly what’s on my to do list after I graduate.

1. Change Your Mailing Address

Your address is officially changing back (or to somewhere new!). Check any profiles or important areas where your address listed is your college one (ie: LinkedIn, your resume, subscription boxes). Make sure you update your magazine subscriptions, too.

It can also be helpful to delete your college address from sites you shop on frequently to avoid any accidental shipments to a place you’re no longer living. Your future self will thank you.

2. Look into “Adult Things”

While in the college bubble, it’s been easy to ignore these and pretend they don’t exist.

1. Insurance

Do you have it? If you’re graduating with a job secured, do they offer insurance plans? How will you be budgeting for car insurance? Health insurance? GEICO offers plenty of types of insurance for your post-grad needs from renter’s to auto. This is a talk you might want to have with your parents, too.

2. Credit Score

Check yours! Do you have one? If not, start building credit! This is going to be very important when it comes to buying a car, renting an apartment or taking out any loan ever.

3. Student Loans

Time to start paying them off! Do you have a payment plan? A budget?

3. Update LinkedIn

Time to mark that college degree as complete. Now is also a good time to refresh your page with a new headshot and a new description, too. It’s also a good time to connect with professors you had a strong connection with.

4. Work on Transportation

Now that you’ve graduated, you might be in the market for a car. Or, you might be in the market for ensuring the car you have is built to last and well-insured.

I suggest checking out 4 Tips For Buying And Insuring Your First Car. Though you might just think of them as an insurance company, GEICO has a lot of helpful resources for saving cash and learning about what you can insure, how you can insure it and why you should.

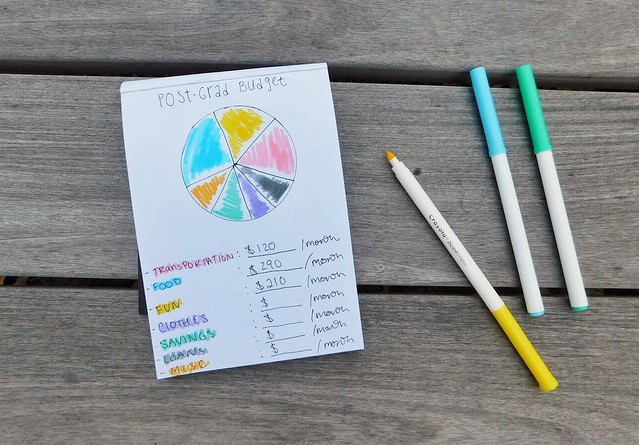

If you, however, do not have a car or the funds to purchase one, map out how much you’ll budget for your alternate transportation. Will you be buying an unlimited Metrocard? A monthly train pass? What’s the cheapest method?

5. Start Budgeting

Speaking of transportation…time to balance finances now that what you’ll be paying for is changing. Now, things like rent and insurance and the lack of textbook costs can alter your post-grad budget.

My Type A side truly shines when it comes to money and budgeting. Really, anything that has the potential to involve a spreadsheet is invigorating. Even if you are not quite as enthusiastic, learning saving hacks can be pretty fun. Learn how to cut back spending on the necessities, like gas and groceries. The best way to do this is by researching plenty of saving tips, like 6 Hacks to Help You Save On Gas.

Then, make a Google Sheet of what you plan to be spending your money on. Try an app. Maybe keep a notebook. Figure out which system will work for you.

6. Make A Concrete Plan to See Friends & Stay in Touch

To the surprise of no one, messages of “Let’s hang out!” and “We’ll totally keep in touch!” are backed by very little action. Book a weekend trip to visit each other in the future.

Make a deal to have monthly Skype dates or in-person brunch dates if you’re all not too far away. You can also add your college’s alumni weekend to your calendar! Consider planning a weekend around that.

7. Get Business Cards

If you don’t have them, make some. I have a lot of business cards sitting in a box and I’ve only handed out a handful of them. If you have them, start handing them out a bit more often. You seriously never know who you could meet.

8. Join Relevant Email Lists

Subscribe to publications you enjoy. If you, like me, are job hunting, subscribe to job posting notifications for your relevant field. Subscribe to some news sites if you’re determined to be more in the loop now that you’re out of the college bubble.

While doing this, also take note of which email lists you’re already subscribed to. Now is the perfect time to start that inbox off fresh by unsubscribing from ones you no longer care to receive.

9. Build Up a Work Wardrobe

This is not to say your entire closet should go from sweatshirts to blazers, but it’s time to make sure you’re ready for job interviews and networking events. Make sure you have all 10 Young Professional Wardrobe Essentials!

10. Create a Memory & File Organization System

A folio or even a shoebox works for this. Go through all of the papers and files you’ve accumulated in college, both digital and physical, and decide what’s worth keeping and what should go.

In terms of memories, develop those photos! And, if you’re particularly crafty, making a scrapbook for each year of college can be a wonderful way to organize your memories.

Some discounts, coverages, payment plans and features are not available in all states, in all GEICO companies, or in all situations. Homeowners, renters and condo coverages are written through non-affiliated insurance companies and are secured through the GEICO Insurance Agency, Inc. GEICO is a registered service mark of Government Employees Insurance Company, Washington, D.C. 20076; a Berkshire Hathaway Inc. subsidiary.

I was selected for this opportunity as a member of CLEVER and the content and opinions expressed here are all my own.

What are some of your post-grad plans?